In the complex landscape of personal finance, your credit score is the reliable compass that guides you through this wild financial world. But what the heck is credit, anyway? Put simply, credit is an agreement between a creditor (lender) and a borrower to repay funds, usually with interest. Essentially, the lender credits the borrower money, which the lender must repay over time.1

Now, let’s shed light on the unsung hero of fiscal responsibility: the beacon that is our credit score. When it comes to your credit score, it shows lenders that you can pay back the funds you borrow. It’s a dynamic force influencing our choices, the opportunities we seize, and the financial doors that either swing open or remain firmly closed.

There is so much information regarding credit that navigating what’s really important can be challenging. So, fasten your seatbelts as we embark on a journey to understand why good credit isn’t just a feather in the financial cap – it’s the fabric that weaves the story of our economic well-being.

Decoding the Credit Landscape: What is Credit?

As mentioned above, credit is a financial arrangement in which a borrower receives something of value, typically money, goods, or services, with the understanding that they will repay the lender at a later date. Credit can include things like:

- Loans

- Lines of Credit

- Credit Cards

- Student Loans

- Mortgages

You may wonder how lenders gauge the financial responsibility of the borrower. The simple answer is your credit score!

At the heart of the credit game lies the concept of creditworthiness, a secret code deciphered through the magic of a credit score. This number taps into a mix of financial elements — think payment history, credit utilization, the length of your credit history, the variety of credit you have, and new credit. Imagine it as a story of financial success, where having a great credit score makes you a money expert, effortlessly swinging open doors to favorable loan terms and irresistibly low interest rates. It’s the force behind borrowing that can turn your fiscal journey into an exciting adventure!

Multiple factors may contribute to determining your credit score, but it is simply represented by a number ranging from 300-850, called your FICO score1. These numbers can be broken down even further:

- >579= Poor Credit

- 580-669= Fair Credit

- 670-739= Good Credit

- 740-799= Very Good Credit

- 800+= Exceptional Credit

So when you go to apply for any kind of credit, the first thing the lender will do is look at your credit score. They will then consider other factors like the length of your credit history, repayment history, and so on. Loans and credit cards aren’t the sole factors influencing your credit score; your credit score also plays a role in determining your insurance rates, affecting your eligibility for renting apartments, and can even be considered by some employers. Your credit score holds significance beyond just lending; it impacts various aspects of your financial life.

What Influences Your Credit Score?

We learned above what factors can influence your credit, but let’s look deeper. Why are these factors important, and how do they affect the lender’s decision to extend credit?

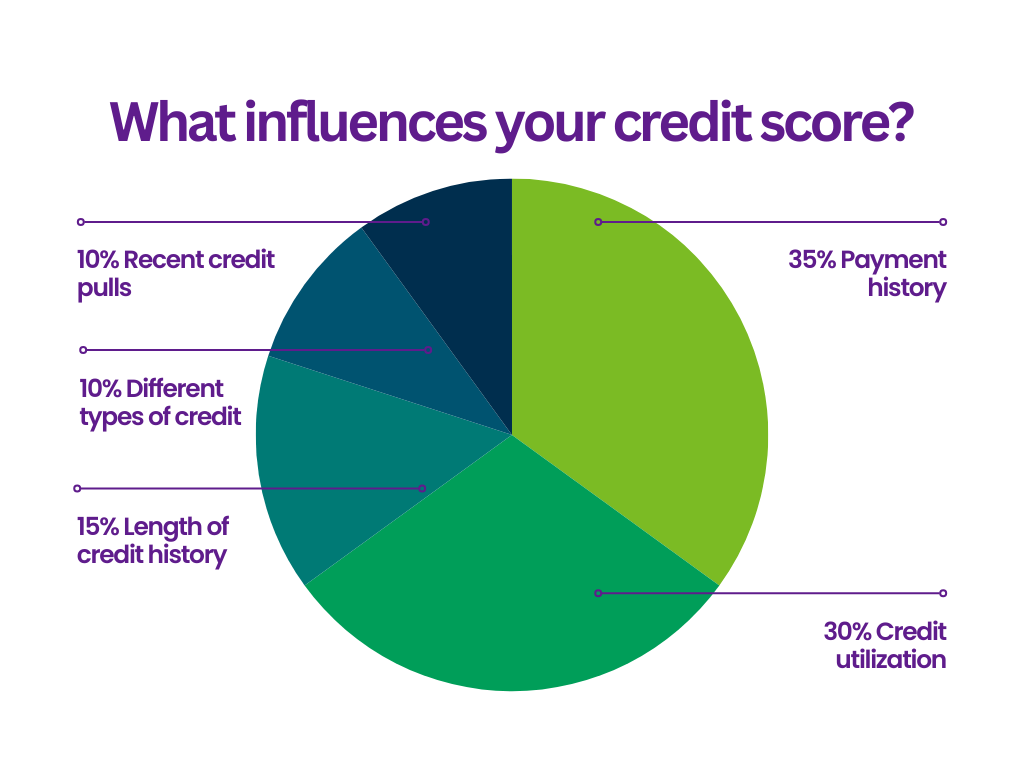

One of the most popular ways to determine your credit score is the FICO score. Here is how the FICO score is calculated2:

- Payment history: 35%

- Credit utilization: 30%

- Length of credit history: 15%

- Different types of credit: 10%

- Recent credit pulls: 10%

If your credit score is low and you want to improve it, focusing on these five factors will help increase that score. Here is precisely what you need to do for each section to become the credit master and have lenders knocking on your door left and right:

Payment History

Payment history makes up the most significant chunk of your credit score. Ensure you pay all fees on time and avoid any missed payments on your report. Missing a payment for anything like a loan, credit card, or even a cellphone payment will harm your credit score, making lenders question whether they will offer you credit.

Credit Utilization

Your credit utilization shows how much of your credit you’re currently using.2 A good rule of thumb is to keep your credit utilization at 30% or lower. For example, if your credit card has a limit of $1,000, keeping your balance at $300 or lower will show lenders that you are responsible with your credit and know how to keep balances paid down. With credit utilization making up the next most significant part of your credit score, keeping those balances paid down is essential!

Length of Credit History

Regarding credit history, lenders want to see that you are responsible with your credit over a long period of time. So that’s why sometimes, even if you have a high credit score but don’t have much credit history, lenders still won’t approve you for any kind of credit. Remember to keep old accounts like credit cards and lines of credit open, as this also contributes to your credit history. If you close these accounts, credit bureaus cannot view them, making it look like there is no history for those accounts. To build up credit history, it simply takes time.

Different Types of Credit

Lenders like to see a mix of different types of credit. They want to see a combination of both revolving credit (like credit cards or lines of credit) and installment credit (personal loans, car loans, or mortgages). Lenders like to see that you are responsible for different kinds of credit and payments.

Recent Credit Pulls

Lenders look into your credit history whenever you apply for a credit card, loan, or other forms of credit. This inquiry can lower your credit score by a few points and is a red flag for lenders if too many inquiries are made at once. Lenders can view this as “risky financial behavior.”2 It’s a good rule of thumb to wait three to six months before making another credit application.

It’s also good to continually monitor your credit score and history. Millions of people in the US have mistakes on their credit reports, and getting them rectified as soon as possible is essential as those errors could negatively affect your score.2

Advantages of a Strong Credit Profile

Let’s dive into the perks of having a robust credit profile. A good credit score can lower interest rates, provide access to superior financial products, and enhance borrowing terms. A strong credit profile is a key that unlocks doors to a myriad of financial opportunities, setting the stage for a more secure and prosperous financial future. The most significant benefits to having good credit are the financial ones, but renting apartments, getting a new job, or a new cellphone contract are all things that benefit from having a solid credit profile. Here are some ways that stellar credit can improve your life and finances.

Better Approval Odds

With a sound credit history, your approval odds are much higher. This means that when you apply for things like credit cards, loans, and mortgages, lenders are more likely to approve your application based on your outstanding credit history.

Amazing Interest Rates

Want interest rates that would make Bill Gates’ jaw drop? Then make sure your credit score is impeccable! A better credit score dramatically increases your chances of having a low-interest rate, saving you tons of money throughout your credit contract.

Better Credit Terms

Having good credit will not only increase your approval odds and interest rates but also allows you to have better terms for your credit. Companies could offer a greater credit card limit or a higher loan balance if you have good credit.

Good Credit is Here to Stay

In the intricate realm of personal finance, your credit score is here as a compass, guiding you through the twists and turns of the financial world. The significance of maintaining good credit shone through as we unraveled the intricacies of credit, from its definition to the pivotal role of your credit score.

Your credit score is more than a number; it’s a silent influencer, shaping choices, unlocking opportunities, and determining the outcome of financial possibility. Mastering your credit involves understanding and actively managing factors contributing to your credit score, transforming it into a tool for prosperity. Whether seeking approval for credit or navigating non-financial realms like housing and employment, the advantages of good credit are unmatched.

As you navigate your financial journey, remember that maintaining a stellar credit score isn’t just about securing loans; it’s about harnessing the power of good credit to navigate the seas of financial opportunity with confidence and resilience. So, manage your credit wisely, and may your financial journey be filled with success, steering you toward a secure and prosperous future.