Last Updated on May 5, 2025 by KashKick Crew

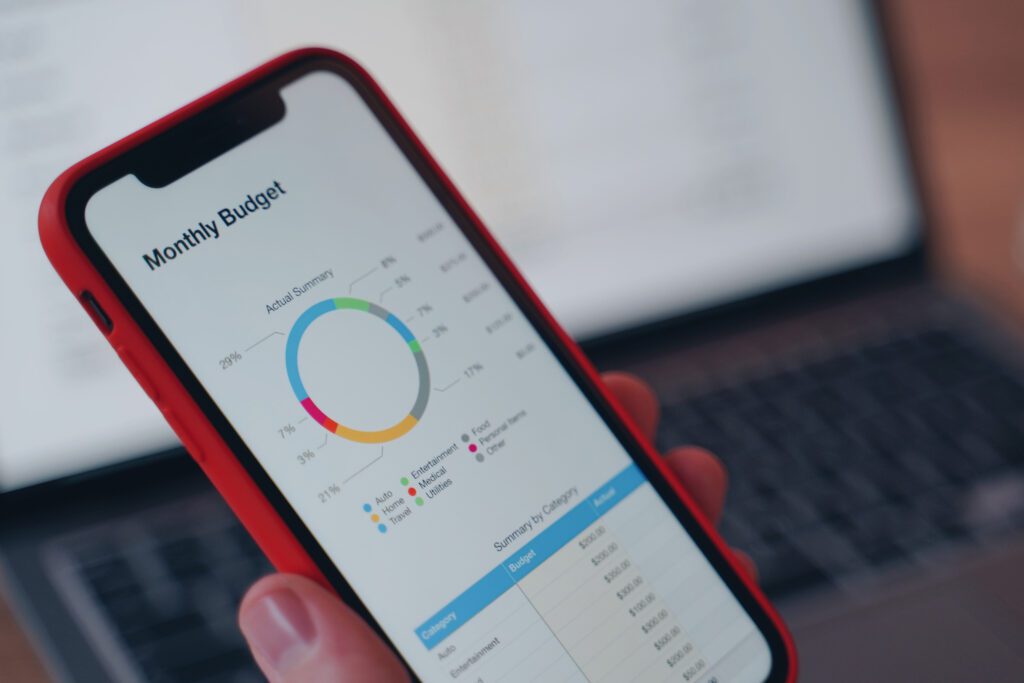

As we hit the halfway mark of the year, it’s an ideal time for a mid-year financial checkup. This process involves evaluating your financial health, tracking your progress, and making necessary adjustments to stay on course. Let’s delve into the key areas you should focus on: reviewing and updating your budget, tracking and analyzing spending habits, checking your savings progress, assessing your investment goals, reviewing your debt repayment progress, and checking your credit report. This comprehensive guide will help you navigate each step and ensure you are on the right track to achieving your financial goals.

Review and Update Your Budget

Why Budget Review is Crucial

A budget isn’t a set-it-and-forget-it tool; it’s a dynamic plan that should evolve with your circumstances. Reviewing your budget mid-year helps you identify any deviations and make adjustments accordingly. This practice not only keeps you aligned with your financial goals but also provides an opportunity to reflect on your spending habits and make necessary changes.

Steps to Review and Update Your Budget

- Compare Planned vs. Actual Spending: Look at your budgeted amounts versus what you have actually spent. This comparison will highlight areas where you may be overspending or underspending. Identifying these areas early is crucial to prevent any financial strain later in the year.

- Adjust for Life Changes: Have there been any significant changes in your income or expenses? Life is unpredictable, and changes such as a new job, a pay raise, or unexpected expenses can impact your budget. Adjust your budget to reflect these changes, ensuring that it remains realistic and achievable.

- Reallocate Funds: If you’ve spent less in one category, consider reallocating those funds to another category, such as savings or debt repayment. This reallocation can help you make the most of your available resources and ensure that you are prioritizing your financial goals effectively.

- Review Subscription Services: Over time, it’s easy to accumulate various subscription services that you might not be using. Take a detailed look at all your subscriptions and cancel those that are not essential or no longer add value to your life.

- Set New Budget Goals: Based on your mid-year review, set new budget goals for the remaining months of the year. These goals should be specific, measurable, achievable, relevant, and time-bound (SMART). Having clear goals will keep you motivated and focused on your financial objectives.

How can you Make Budgeting Fun? Read more.

Track and Analyze Spending Habits

Understanding Spending Patterns

Tracking your spending habits provides insight into where your money is going and helps you identify areas for improvement. By understanding your spending patterns, you can make informed decisions that align with your financial goals.

Tools and Techniques

- Use Budgeting Apps: Apps like Mint, YNAB (You Need a Budget), and PocketGuard can help you track spending and categorize expenses. These apps provide a visual representation of your spending habits, making it easier to identify areas where you can cut back.

- Review Bank Statements: Go through your bank and credit card statements to identify patterns and spot unnecessary expenditures. Regularly reviewing your statements can help you catch any fraudulent charges early and keep your spending in check.

- Set Spending Limits: Based on your analysis, set spending limits for discretionary categories to avoid overspending. This practice can prevent impulse purchases and ensure that you are living within your means.

- Track Cash Flow: In addition to tracking expenses, it’s important to monitor your cash flow. Ensure that your income consistently exceeds your expenses. Positive cash flow is crucial for building savings and reducing debt.

- Create a Spending Diary: For a more detailed analysis, consider maintaining a spending diary for a month. Write down every purchase you make, no matter how small. This practice can reveal spending habits that you might not have been aware of and provide insights into where you can make adjustments.

Check Savings Progress

Importance of Regular Savings Check-Ins

Regularly checking your savings progress ensures that you’re on track to meet your financial goals, whether it’s for an emergency fund, a vacation, or retirement. Consistent saving is key to financial security and achieving long-term objectives.

How to Assess Savings Progress

- Evaluate Your Savings Rate: Calculate the percentage of your income that you’re saving. Aim for at least 20% of your income if possible. If you find that you are saving less, look for ways to cut back on expenses and increase your savings rate.

- Compare with Goals: Compare your current savings with your mid-year goals. Are you on track, ahead, or behind? Use this comparison to adjust your savings strategy and ensure that you meet your targets by the end of the year.

- Automate Savings: Consider setting up automatic transfers to your savings account to ensure consistent contributions. Automating your savings can help you prioritize saving over spending and eliminate the temptation to spend extra cash.

- Emergency Fund Check: Ensure that your emergency fund is adequately funded. Aim for at least three to six months’ worth of living expenses. Having a well-funded emergency fund can provide peace of mind and financial stability in case of unexpected events.

- Reevaluate Short-Term and Long-Term Goals: Regularly reevaluate both your short-term and long-term savings goals. Adjust them as necessary to reflect any changes in your financial situation or priorities.

Need to open a Savings Account? Check out these offers from KashKick to get rewarded for opening an account.

Assess Investment Goals

Aligning Investments with Goals

Your investment strategy should align with your long-term financial goals, such as buying a home, funding education, or retirement. Regularly assessing your investments ensures that they remain on track to meet these goals.

Steps to Assess Investment Progress

- Review Portfolio Performance: Analyze the performance of your investments over the past six months. Are they meeting your expectations? Compare the performance with relevant benchmarks and make adjustments if necessary.

- Rebalance Your Portfolio: Ensure your investment mix is still in line with your risk tolerance and goals. Rebalancing your portfolio can help you maintain your desired asset allocation and manage risk effectively.

- Consult a Financial Advisor: If you’re unsure about your investment strategy, consider seeking advice from a financial advisor. A professional can provide personalized recommendations and help you navigate complex investment decisions.

- Assess Risk Tolerance: As your life circumstances change, your risk tolerance may also change. Reassess your risk tolerance and adjust your investment strategy accordingly. Ensure that your portfolio reflects your current financial situation and goals.

- Review Fees and Expenses: Investment fees and expenses can significantly impact your returns. Review the fees associated with your investments and look for lower-cost alternatives if possible. Minimizing fees can help you maximize your investment returns.

Want to Start Investing? Here are 5 KashKick offers that will help you get started AND earn you a reward.

Review Debt Repayment Progress

Staying on Top of Debt

Regularly reviewing your debt repayment progress helps you stay on track and make adjustments to pay off debt faster. Reducing and eliminating debt is crucial for achieving financial freedom and improving your overall financial health.

How to Monitor Debt Repayment

- List All Debts: Create a list of all your debts, including balances, interest rates, and minimum payments. This comprehensive overview will help you prioritize which debts to tackle first.

- Track Payments: Keep track of all payments made over the past six months. Have you been able to make more than the minimum payments? Making extra payments can accelerate debt repayment and save you money on interest.

- Explore Repayment Strategies: Consider different repayment strategies like the snowball or avalanche methods to accelerate debt repayment. The snowball method involves paying off the smallest debt first, while the avalanche method focuses on paying off the debt with the highest interest rate first. Choose the strategy that best fits your financial situation and motivation.

- Consolidate Debt: If you have multiple high-interest debts, consider consolidating them into a single loan with a lower interest rate. Debt consolidation can simplify your repayment process and reduce the amount of interest you pay.

- Negotiate with Creditors: If you’re struggling to make payments, consider negotiating with your creditors for lower interest rates or more manageable repayment terms. Many creditors are willing to work with you to avoid defaults.

Check Your Credit Report and Fix Any Problems You See

Importance of Regular Credit Report Checks

Your credit report is a crucial aspect of your financial health. It affects your ability to secure loans, get favorable interest rates, and even rent apartments or get certain jobs. Regularly checking your credit report helps you stay on top of your credit status, identify errors, and take steps to improve your credit score.

Steps to Check Your Credit Report

- Obtain Your Credit Report: You’re entitled to a free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once a year. Visit AnnualCreditReport.com to request your reports. Consider staggering your requests so you can check your credit every four months.

- Review for Errors: Carefully examine each section of your credit report, including personal information, account information, and public records. Common errors include incorrect personal details, accounts that don’t belong to you, and incorrect account statuses.

- Look for Signs of Identity Theft: Unrecognized accounts or inquiries may indicate identity theft. If you spot any suspicious activity, take immediate action to address it.

How to Fix Credit Report Errors

- Identify and Document Errors: Make a list of all the errors you find. Gather any supporting documents that can help prove the inaccuracies, such as account statements or correspondence with creditors.

- Dispute Errors with Credit Bureaus: Write a dispute letter to the credit bureau reporting the error. Clearly identify each error, explain why it’s incorrect, and include copies of supporting documents. You can dispute errors online, by mail, or by phone. The credit bureau must investigate your claim within 30 days.

- Contact the Creditor: If the error is related to a specific creditor, contact them directly. Explain the issue and request that they correct the information with the credit bureaus. Provide any necessary documentation to support your claim.

- Follow Up: Monitor the progress of your dispute by regularly checking your credit report. The credit bureau will provide the results of their investigation and a free copy of your credit report if a change is made.

- Consider Adding a Consumer Statement: If a dispute doesn’t resolve in your favor, you can add a brief consumer statement to your credit report explaining the issue. While this doesn’t change the report, it allows you to present your side to potential creditors.

Steps to Improve Your Credit Score

- Pay Bills on Time: Your Mpayment history is the most significant factor in your credit score. Ensure you pay all your bills on time, every time. Setting up automatic payments or reminders can help.

- Reduce Debt: High levels of debt relative to your credit limit can lower your credit score. Focus on paying down your existing debt and avoid taking on new debt if possible.

- Keep Credit Utilization Low: Aim to use less than 30% of your available credit at any given time. If possible, pay off your credit card balances in full each month.

- Limit Hard Inquiries: Each hard inquiry (when a lender checks your credit report for a loan application) can slightly lower your credit score. Limit the number of hard inquiries by applying for new credit only when necessary.

- Maintain Older Accounts: The age of your credit accounts contributes to your credit score. Keep older accounts open and active to demonstrate a long credit history.

- Diversify Credit Types: Having a mix of credit types (e.g., credit cards, installment loans, mortgage) can positively impact your credit score. However, don’t take on new debt just for the sake of diversification.

Read more about the Importance of Good Credit.

Making Adjustments

How to Adjust Your Financial Plan

After reviewing each area, identify where adjustments are needed to stay on track for the rest of the year. Making proactive adjustments can help you achieve your financial goals more effectively and avoid potential pitfalls.

- Set New Goals: Based on your review, set new financial goals or adjust existing ones to better align with your current situation. Your goals should be realistic and achievable, providing a clear direction for your financial planning.

- Create an Action Plan: Develop a plan to achieve your adjusted goals, including specific steps and deadlines. Break down your goals into manageable tasks and set milestones to track your progress.

- Monitor Regularly: Schedule regular check-ins, such as monthly or quarterly reviews, to ensure you stay on track. Regular monitoring allows you to make timely adjustments and stay focused on your financial objectives.

- Stay Flexible: Life is full of surprises, and your financial plan should be flexible enough to accommodate changes. Be prepared to adjust your plan as needed to reflect new circumstances or priorities.

- Celebrate Milestones: Achieving financial goals can be challenging, so it’s important to celebrate your milestones along the way. Recognizing your progress can keep you motivated and reinforce positive financial habits.

A mid-year financial checkup is essential for maintaining financial health and achieving your goals. By taking the time to review and adjust your budget, spending habits, savings, investments, and debt repayment, you can ensure a successful financial year. With a clear plan and regular monitoring, you’ll be well on your way to achieving your financial dreams.

Additional Tips for a Successful Financial Checkup

- Stay Informed: Keep yourself updated on financial news and trends. Being informed can help you make better financial decisions and stay ahead of potential challenges.

- Seek Professional Advice: If you feel overwhelmed or unsure about your financial decisions, don’t hesitate to seek professional advice. A financial advisor can provide valuable insights and help you create a robust financial plan.

- Prioritize Self-Care: Financial health is an important aspect of overall well-being. Ensure that you are taking care of yourself and managing stress effectively. A healthy mindset can positively impact your financial decisions and overall quality of life.

By following these steps and tips, you’ll be better equipped to navigate your financial journey and achieve your goals. A mid-year financial checkup is more than just a review; it’s an opportunity to take control of your finances and build a secure and prosperous future.